Supply chains have always run on people making quick calls under pressure, but now they’ve got better tools.

With analytics and business intelligence partners pulling signal from the noise, teams can spot issues sooner, plan with more confidence, and keep promises without constant firefighting. It’s still human judgment, just backed by smarter data.

1) Control Towers: BI That Stops the “Whose Spreadsheet is Right?” Debate

A supply chain “control tower” sounds futuristic, but the day-to-day win is painfully practical: one shared, trusted view of orders, inventory, shipments, exceptions, and commitments.

Gartner defines a supply chain control tower as a concept combining people, process, data, organization, and technology to capture and use close to real-time operational data across the ecosystem for better visibility and decision-making.

BI is the engine that makes that possible: integrating ERP, WMS, TMS, supplier EDI/ASNs, and customer order feeds into a model that matches “the same thing” across systems (SKU, PO, lane, location, promised date). Then it shifts from vanity dashboards to exception-driven ops:

- Late ASNs and missed milestones (pickup, gate-in, discharge, delivery).

- Dwell time spikes by node and lane.

- OTIF erosion by supplier or carrier.

- Allocation conflicts (inventory exists, but it’s reserved or stranded).

This is the control-tower logic most readers of IT Supply Chain will recognize immediately: the “tower” isn’t a TV screen; it’s the decision discipline that says, “Show me the handful of things that will break service if we ignore them for the next six hours.”

2) Demand Sensing and Forecasting: Fewer Surprises for More Explainable Predictions

BI-powered forecasting isn’t just a model spitting out a number. It’s a loop: ingest signals, predict demand, measure error, learn, and push actions back into planning.

IBM describes supply chain planning as unifying teams (sales, marketing, and supply chain operations) around a single source of truth, using AI and advanced analytics for demand planning and forecasting.

What that looks like in real operations: BI layers your forecast with context and guardrails, so planners aren’t blindly trusting a black box.

- Driver-based views: promo calendars, price changes, channel mix, seasonality, regional demand spikes.

- Forecast bias and volatility tracking: which SKUs are consistently over-forecasted, and where does lead-time variability make errors expensive.

- Tolerance-based alerts: “demand is up 18% vs. baseline in Region B” triggers a replenishment review before the stockout wave starts.

The quiet superpower here is explainability. People don’t need less data. They need to understand what moved, what matters, and what action is rational.

3) Digital Twins + Scenario Planning: Stress-Testing Decisions Before Reality Happens

If BI tells you what’s happening, scenario planning lets you ask, “What happens if we change this?”

McKinsey notes that when combined with digital twins, supply chain tools can deliver real-time visibility into granular performance plus predictive and prescriptive analytics to identify risks and recommend policy changes quickly.

BI is what supplies the digital twin with credible inputs: constraints, capacities, lead times, service targets, cost-to-serve, and reliability by supplier and lane.

That enables scenario runs that are actually useful, not just impressive:

- Re-route freight to avoid congestion: cost vs. service vs. carbon trade-offs;

- Switch suppliers: impact on lead time, quality risk, and MOQ-driven inventory;

- Change reorder points: working capital impact vs. fill-rate impact;

- Allocation rules during shortages: who gets product and what revenue you protect.

This is where the smart supply chain becomes more than visibility. It becomes decision intelligence: you can show stakeholders the trade-offs in numbers instead of debating them in vibes.

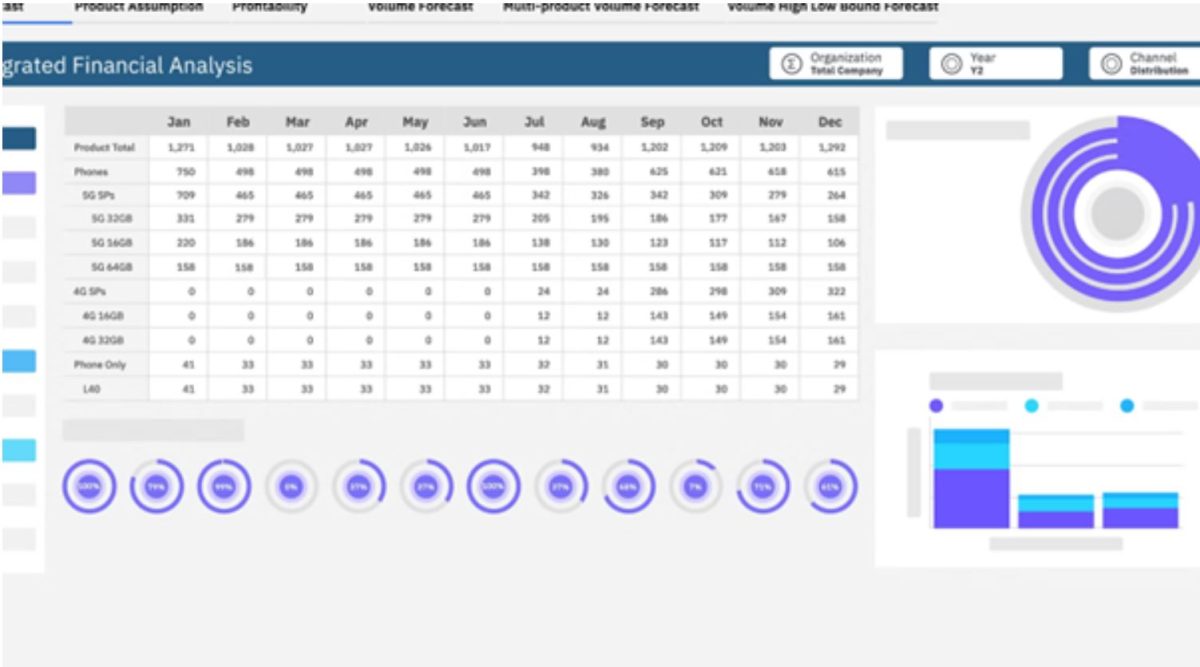

4) Inventory Intelligence: From “On-Hand”, to ATP You Can Trust

Most inventory pain comes from a simple misconception: “in stock” is not the same as “available.” BI makes inventory measurable in the way customers experience it: availability and promise accuracy.

Microsoft’s Inventory Visibility guidance explicitly supports connecting a sample Power BI dashboard to an Inventory Visibility instance and other data sources to visualize inventory across regions, entities, and channels, and to identify out-of-stock/understocked/overstocked products for timely action.

A strong BI inventory layer typically includes:

- Available-to-promise (ATP) vs. on-hand vs. reserved vs. in-transit;

- Velocity segmentation (A/B/C items) tied to service targets;

- Aging and obsolescence risk tied to margin and carrying cost;

- Network imbalance detection (stock is “healthy” globally but stranded locally).

In practice, BI helps teams stop overreacting with expediting and start fixing root causes: lead-time variance, poor MOQ decisions, or misallocated safety stock.

5) Supplier Collaboration: Fewer E-mails, More Shared Facts

Instead of treating suppliers like a black box (or a blame box), BI is increasingly used as a shared performance and planning layer: clean, consistent data about forecasts, inventory buffers, lead-time variability, quality trends, and on-time performance that both sides can act on.

The point isn’t to “score” a supplier; it’s to reduce noise and tighten decisions: earlier risk flags, better commit dates, fewer surprise expedites, and clearer root-cause analysis when something slips.

A clean way to anchor this is the concept of moving from siloed reporting to integrated supply chain planning and collaboration, which SAP discusses as enabling better visibility and coordination across partners.

Summary

BI turns supply chains into systems you can run, not mysteries you react to.

When visibility, forecasting, scenario testing, and inventory truth all live in one analytical spine, teams stop guessing, stop arguing, and start choosing.