Descartes Systems Group, the global leader in uniting logistics-intensive businesses in commerce, released its November Global Shipping Report for logistics and supply chain professionals. In October 2025, U.S. container import volumes were 2,306,687 twenty-foot equivalent units (TEUs), down a slight 0.1% from September and 7.5% lower than October 2024.

After volume declines in August and September, imports from China were up 5.4% over September but down 16.3% year-over-year. Compared to September, port transit time delays increased modestly in October across most top U.S. ports.

The October update of the logistics metrics monitored by Descartes suggests continued importer caution amid persistent trade uncertainty and likely frontloading activity that occurred in previous months as importers adjusted to evolving tariffs.

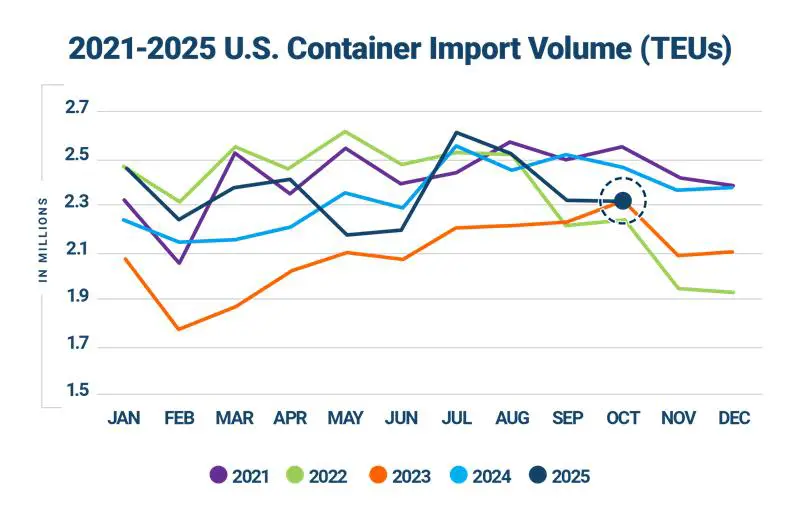

U.S. container imports essentially flat in October as year-to-date volumes continue to decrease.

October imports dipped a marginal 0.1% over September and were down 7.5% from October 2024 (see Figure 1). For the first ten months of 2025, volumes are just 0.9% above the same period in 2024. Compared to 2024, the year-to-date growth margin has steadily narrowed this year—from nearly 10% in January to now less than 1% in October—suggesting that ongoing trade volatility, suspected frontloading earlier in the year, and slower consumer demand has slowed momentum.

Figure 1. U.S. Container Import Volume Year-over-Year Comparison

Source: Descartes Datamyne™

Imports from the top 10 countries of origin (CoO) posted a slight 1.3% month-over-month increase with a combined gain of 21,301 TEUs (see Figure 2). The modest rebound was driven by China, which rose 5.4% (41,129 TEUs), increasing its share of total U.S. imports to 34.9% in October from 33.0% in September. Significant gains in October were also recorded from Japan (25.2%), Italy (13.0%), and South Korea (8.2%). Hong Kong also increased 3.9%. In contrast, India fell 19.0%, Thailand 6.0%, Vietnam 4.8%, Germany 3.8%, and Indonesia 3.3%.

Figure 2. September 2025 to October 2025 Comparison of U.S. Import Volumes from Top 10 Countries of Origin

Source: Descartes Datamyne™

“Despite an increase in volumes from China, overall U.S. container imports dipped slightly in October compared to September,” said Jackson Wood, Director of Industry Strategy at Descartes (pictured right) . “October’s performance likely signals ongoing caution among U.S. importers facing persistent geopolitical friction and regulatory volatility, which drive higher levels of supply chain uncertainty and complexity as policies shift and evolve quickly.”

Descartes began its global shipping analysis in August 2021. To read past monthly reports, learn more about the key economic and logistics factors driving global shipping, and review strategies to help address challenges in the near-, short-, and long-term, visit Descartes’ Global Shipping Resource Center.

About Descartes

Descartes is the global leader in providing on-demand, software-as-a-service solutions focused on improving the productivity, security and sustainability of logistics-intensive businesses. Customers use our modular, software-as-a-service solutions to route, track and help improve the safety, performance and compliance of delivery resources; plan, allocate and execute shipments; rate, audit and pay transportation invoices; access global trade data; file customs and security documents for imports and exports; and complete numerous other logistics processes by participating in the world’s largest, collaborative multimodal logistics community. Our headquarters are in Waterloo, Ontario, Canada and we have offices and partners around the world. Learn more at www.descartes.com, and connect with us on LinkedIn and Twitter.