Supply-chain IoT is booming: IoT Analytics says global cellular IoT connections surpassed four billion in 2024.

Every pallet sensor, reefer probe, and yard camera needs an always-on path to the cloud—but no single network covers every lane.

By blending global carriers, agile IoT MVNOs, satellite-cellular hybrids, and aggregator tech, you can keep data flowing everywhere.

In this guide, we profile five standout providers, explain the criteria we used to rank them, and give you a side-by-side comparison so you can choose a connectivity partner with confidence.

Methodology: how we built the shortlist

Global supply chains increasingly rely on mixed cellular, LPWAN, and satellite networks to keep IoT data flowing everywhere.

We started with Gartner’s 2025 Magic Quadrant for Managed IoT Connectivity Services, which profiles 15 global carriers and MVNOs. Landing in the Leader or Visionary quadrant proved each provider’s scale and innovation.

From there, we applied four pass-fail filters:

- Borderless coverage: Multi-network SIMs must roam on 4G/5G and extend to LTE-M, NB-IoT, or satellite for hard-to-reach lanes.

- Logistics pedigree: Public case studies must feature live deployments in transportation, warehousing, or manufacturing—not just smart meters.

- Open integrations: A self-service portal plus REST or MQTT APIs must feed data straight into your TMS or ERP.

- Verifiable metrics: Providers need published device counts, uptime targets, or customer wins that an auditor can check (for example, Orange’s 40 million connected assets).

Any single-country telco or software-only visibility platform dropped out, leaving five finalists: an aggregator, two independent IoT MVNOs, one tier-1 operator, and a satellite-cellular specialist. Together they cover nearly every connectivity scenario a modern supply chain faces, giving you a practical menu—not a recycled “top 10” list.

TD SYNNEX ConnectSolv – the one-stop aggregator

Why it matters

- Global reach. TD SYNNEX supports more than 150,000 customers in over 100 countries, and ConnectSolv taps that footprint through preferred agreements with tier-1 carriers and MVNOs. Recent work with Transatel extends 5G eSIM plans across Europe, while a 2025 alliance with KORE adds U.S. OmniSIM options for low-power assets.

- Hardware arrives activated. TD SYNNEX ships millions of devices each year; ConnectSolv overlays pre-provisioned SIMs so a cold-chain sensor streams data as soon as it leaves the box.

- Channel-validated program. CRN gave ConnectSolv a five-star rating in its 2024 Partner Program Guide for above-average training, support, and margin programs.

How it works

1. Choose a data plan mix (LTE-M for pallet tags, 5G for yard cameras) inside a self-service portal.

2. Bundle connectivity with gateways, tablets, or sensors on the same PO.

3. Rely on a 24/7 IoT desk that speaks both radio metrics and warehouse workflows; no rerouting to a consumer call center at 2 am.

Pilots start small: a regional 3PL can light up 500 trackers without minimum-commit penalties. A global retailer can roll out 50,000 assets and still monitor everything in the same dashboard.

For supply-chain leaders who need carrier choice, device variety, and audit-ready billing in weeks, not quarters, ConnectSolv turns procurement complexity into a single, predictable line item. According to TD SYNNEX ConnectSolv program materials, resources such as the Connectivity and Connected Hardware Program Manual and the tech solutions guide lay out how to bundle 5G cellular gateways, private wireless networks, routers, and network access into repeatable solution stacks, so operations teams are not designing every warehouse or fleet deployment from scratch.

KORE Wireless – global IoT without the telco baggage

KORE is a pure-play IoT provider, so every dollar it earns comes from connecting machines, not phone plans. That focus shows in the numbers:

- 400+ mobile networks in more than 200 countries. One multi-IMSI SIM roams between carriers automatically, so a pallet tag that leaves Chicago and lands in Shenzhen stays online.

- 20 million eSIM profiles under management across logistics, healthcare, and energy.

- Five consecutive years as a Leader in Gartner’s Magic Quadrant for Managed IoT Connectivity Services (2020 to 2024).

Momentum accelerated in June 2023 when KORE acquired Twilio’s IoT business, adding the Super SIM and OmniSIM product lines and roughly 850,000 active connections. Executives call the combined platform an “IoT hyperscaler” because it can light up thousands of devices in minutes through cloud APIs.

Control lives in KORE One, a web console where operations teams can:

- set data ceilings per asset,

- push new carrier profiles over the air, and

- stream usage records into a TMS or ERP by REST or MQTT.

If reefers go dark mid-voyage, a 24/7 network operations center works directly with underlying carriers, sparing you the three-way blame game typical of roaming outages.

For supply chains that cross borders daily and need one SLA, one invoice, and zero lock-in, KORE offers carrier-grade reach without carrier red tape.

Aeris Communications – carrier-grade reach with startup agility

Aeris earned its stripes in automotive, where “zero downtime” is non-negotiable. That pedigree deepened in 2023 when the company acquired Ericsson’s IoT Accelerator platform, an asset that now supports 93 million connected devices across nearly 30 mobile-network partners on five continents.

Coverage is only the start. The Unity console scores every SIM in real time, flags data anomalies, and recommends the lowest-cost local network. Early pilots cut connectivity spend by up to 18 percent.

Security is built in. Because Aeris owns its global core, traffic never crosses the public internet unencrypted. One click in Unity enables private APNs or locks a SIM to a specific device IMEI—controls auditors expect from pharmaceutical and cold-chain shippers.

Flexible pricing keeps finance teams happy: bursty forklift cameras can share pooled 4G data, while dormant pallet tags drop to a standby rate until peak season.

Every enterprise account gets a named IoT architect who can adjust MQTT settings or interpret GSMA eSIM specs—support that feels more SaaS than telco.

If you need global uptime without carrier red tape, and want analytics and security baked in rather than bolted on, Aeris earns its place as a Gartner-recognized Visionary.

Orange Business Services – big-telco backbone, IoT specialist focus

When board members want a name they know, Orange—the French incumbent that still owns and operates mobile networks on three continents—checks the box. Yet its IoT unit behaves more like a specialist than a legacy telco.

Scale and recognition. Orange steers more than 40 million connected devices and, in March 2025, earned its eighth straight Leader spot in Gartner’s Magic Quadrant for Managed IoT Connectivity Services. A single contract covers roaming in over 160 countries, so a trailer can roll from Spain to Senegal without the billing surprises that plague consumer SIMs.

Platform depth. The Live Objects console bulk-provisions trackers, streams raw MQTT into any cloud, and fires usage alerts before costs spike. Need traffic to stay off the public internet? Select private APN and data travels only on Orange’s backbone.

Industry toolkits. Logistics teams use pre-built cold-chain bundles that pair NB-IoT temperature probes with analytics dashboards, while manufacturers deploy Orange private 5G inside large warehouses for AGV control at sub-10 ms latency. Because the same group owns the spectrum, backhaul, and SIM lifecycle, support tickets rarely “escalate to the carrier”—Orange is the carrier.

Security and compliance. Orange runs ISO 27001-certified IoT cores and security operations centers, and encrypts all traffic end to end, satisfying pharma and food-safety audits.

Pricing sits above MVNO levels, but many enterprises pay the premium to consolidate WAN, LAN, and IoT under one global vendor. If you need carrier-grade uptime with specialist IoT brains, Orange proves a flagship telco can still innovate for modern supply-chain realities.

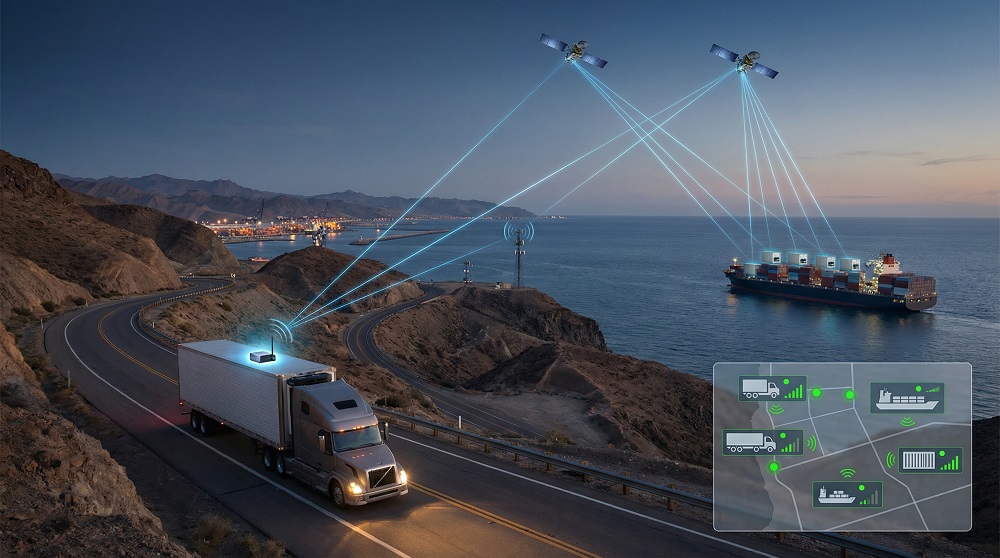

ORBCOMM – satellite-cellular coverage when “no service” is not an option

ORBCOMM runs a network of 20 low-Earth-orbit satellites and 565 cellular-roaming agreements, connecting more than one million assets from reefers to mining machines worldwide. Dual-mode devices start on LTE-M or 4G; if signal fades, they switch to satellite in under eight seconds, keeping GPS, temperature, or door-open alerts flowing without driver action.

Dual-mode satellite and cellular IoT connectivity keeps cold-chain and remote shipments online, even far beyond normal network coverage.

That resilience underpins long-haul cold-chain fleets and maritime lines such as Maersk, which relies on ORBCOMM hardware for real-time reefer data across oceans. A single vendor supplies the rugged sensor, airtime, and cloud dashboard, so TMS teams ingest one clean data feed instead of stitching cellular and satcom APIs.

Innovation keeps bills in check. A 2023 partnership with u-blox embedded ORBCOMM’s satellite link into mass-market IoT modules, cutting hardware costs by roughly 35 percent for small fleets. Users pay standard cellular rates when coverage exists and about US $0.05 for a 50-byte satellite burst—small change compared with a spoiled seafood load.

A 24/7 Network Control Center in Virginia monitors both RF paths and can remotely reboot a device that stops transmitting, often before operations notice.

Choose ORBCOMM when shipments cross deserts, fishing lanes, or mountain passes. For supply-chain managers who view “always on” as non-negotiable, satellite and cellular parity is the ultimate insurance policy.

How the five stack up at a glance

| Vendor | Network mix | Stated reach | Management console | Supply-chain proof point | Third-party validation* |

| ConnectSolv | Cellular 4G/5G; LPWAN and satellite via carrier partners | Distributor presence in 100+ countries | Partner Portal with API export | Pre-activated sensor bundles for retail DCs | Fortune 500 parent TD SYNNEX |

| KORE | Cellular 2G–5G, LTE-M, NB-IoT; satellite partners | 200+ countries, 400 mobile networks | KORE One (REST/MQTT) | 50 K smart reefers on pooled data plans | Gartner MQ Leader 2018-2025; 20 M active SIMs |

| Aeris | Cellular 2G–5G, LTE-M, NB-IoT | About 190 countries, 30 operator partners | Unity (real-time scoring) | 9 K fleets on Connected-Vehicle Cloud | Gartner Visionary; 93 M devices |

| Orange Business | Cellular 2G–5G, NB-IoT; private 5G | 160+ countries; owns or roams | Live Objects (MQTT/HTTPS) | Cold-chain kits and private-5G ports | Gartner MQ Leader 8 years; 40 M devices |

| ORBCOMM | LTE-M/4G plus proprietary LEO satellite | 90-country cellular and 20 LEO satellites | ORBCOMM Cloud (unified feed) | 1 M+ containers, trailers, vessels | Frost & Sullivan 2024 innovation award |

*Validation sources include the Gartner Magic Quadrant 2025, company earnings releases, and analyst awards cited in vendor sections.

Key considerations when choosing a connectivity partner

Choosing an IoT carrier feels academic until something breaks. One industry study estimates the average cold-chain failure at US $500,000 per shipment, while unscheduled downtime drains 11 percent of annual revenue at large manufacturers. The checklist below helps you avoid those losses:

- Coverage first. Plot your lanes, yards, and warehouses on a map. If even one segment sits in a dead zone, budget for dual-mode SIMs or satellite fail-over—insurance that costs cents per day compared with a spoiled load.

- Integration. Your WMS, TMS, and ERP already run the business. Choose providers that expose clean REST or MQTT feeds so telemetry flows straight into those systems without custom middleware.

- Service-level agreements. “Best effort” will not save you when a missed ping shutters a production line. Demand contractual uptime of at least 99.9 percent, documented escalation paths, and financial remedies.

- Security and compliance. Look for private APNs, eUICC/eSIM for local-profile swaps, and device-level firewalls. Ask for ISO 27001 or SOC 2 certificates and review data-residency options for regulated markets.

- Real support. File a ticket on a weekend during evaluation. Track response time and confirm that the engineer can read RF logs instead of copying from a script.

Treat these five gates as pass-fail. When a provider clears them, you gain a partner who keeps inventory moving and headline-making disruptions off your balance sheet.

Trends shaping tomorrow’s connected supply chain

Staying connected is a moving target. The five shifts below will reshape logistics networks through 2030—plan for them now or retrofit later.

Private 5G, LPWAN sensors, LEO satellites, and AI-driven networks will reshape connected supply chains by 2030.

- Private 5G moves from pilot to production. Analysts count more than 1,200 private-5G deployments worldwide as of mid-2025, triple the 2023 total, with warehouse and port projects needing sub-10 ms latency for AGVs and machine vision. Providers such as Orange bundle spectrum, radios, and SIMs so operations teams can launch without telecom licensing.

- LPWAN sensors get ultra-cheap. NB-IoT and LTE-M chipsets fell below US $3 in 2025, and GSMA projects five billion low-power cellular devices on air by 2030. Pallet-level tracking and disposable smart labels will flood data lakes, so pick partners whose platforms can ingest millions of “whispering” endpoints.

- LEO satellites go mainstream. Gartner expects end-user spending on low-Earth-orbit connectivity to hit US $14.8 billion in 2026, up 25 percent year over year. Blended cellular-satellite modems will become default for high-value or remote cargo.

- Regulation targets permanent roaming. The EU and India tightened rules in 2024, pushing multinational fleets toward eUICC and multi-IMSI SIMs that swap to local carriers over the air—an ability only a few providers (Aeris, KORE, Orange) expose today.

- AI shifts from dashboard to backbone. Network cores now use machine-learning models to reroute traffic, predict outages, and optimize data plans in real time; early adopters report up to 18 percent lower connectivity spend when algorithms auto-select the cheapest local carrier.

Takeaway: Flexibility wins. Choose vendors investing in 5G, LPWAN, satellite, and software-defined cores, and your supply chain will stay connected no matter how the technology—or the rules—evolve.

Conclusion

Supply-chain digitization depends on bullet-proof connectivity that spans warehouses, highways, oceans, and everything in between. The five vendors profiled here—ConnectSolv, KORE, Aeris, Orange Business Services, and ORBCOMM—cover virtually every use case, from everyday pallet tracking to mission-critical cold-chain monitoring. By mapping your lanes, integrations, and support expectations against the considerations above, you can select a partner that delivers reliable data today and adapts to tomorrow’s network and regulatory shifts.